After 7 years our lead acid traction batteries were at their end. Their effective capacity was still 22.5 kWh, about 50% of their original 55 kWh. This is still enough to live comfortably, but this would quickly become less, so it was time for a renewal.

In our last article we checked the alternatives. We compared lead acid to Lithium Ferro Phosphate (LiFePo4 , or LFP) batteries. We had to conclude that:

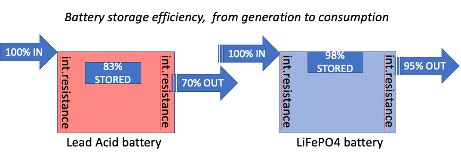

- The overall storage efficiency is 25% better

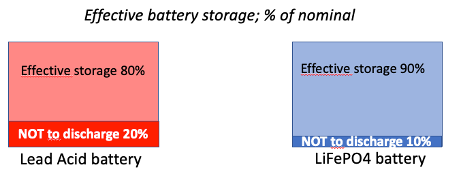

- You can discharge them till 10% of their capacity.

- They are 3X lighter, take 5X less space, are inherently safer, have near zero maintenance and the environmental impact appears to be lower.

- The durability is roughly two times longer.

Always thought these LiFePO4 were way too expensive? We made a cold analysis and shaped it in a business case.

Business case Lead Acid versus LiFePO4

This business case about Lead Acid traction batteries versus Lithium Ferro Phospate batteries is based on:

- Storage durability

- Storage efficiency

- Maintenance costs

- Safety,

- Sustainability and other future risks for our children

First, we pick the right LFP battery bank:

- What we need is an electrical energy buffer of about 20-25 kWh. Say 22.5 kWh effectively.

- It would be nice if the new batteries would last longer than 10 years.

- Just like the lead acid batteries, the LFP must be A brand, delivered by a reliable company, with warranty and service after purchase.

The LiFePO4 batteries will decrease to an estimated 70% after 12 years. So, if we still want to take 22.5 kWh, we need to start with new batteries of

100/70% X 22.5kWh = 32.1 kWh effectively. So far for the durability.

Storage efficiency

It costs energy to ‘push’ the electricity into the battery, and again to ‘pull’ it out. Check the last article for the full explanation. If we take the energy out of an LiFePO4 battery, it costs some 2% of the energy.

So, if you have 32.1 kWh in your LFP battery, you can only get out of it: 98% X 32.1 kWh = 31.4 kWh. From a lead acid that would be 28 kWh.

The LiFePO4 and Lead Acid traction battery compared.

Effective storage

If you buy a battery, you find the Ah of kWh number on it, which is the nominal storage capacity. This is the total storage capacity, if you would empty the battery to 0%. This is theory! Never do it, you damage your battery! A good traction lead acid can go down to 20%, and an LFP to 10% of its nominal value. We call this the effective storage capacity. Because that is what we want to have.

Like we did with our lead acid (or at least till year 6), we like to stay on the safe side and intend never to discharge to the very minimum. So, we prefer to take an extra margin of 15%. So, we take 85% out of it as maximum.

So, if we want an effective storage of 31.4 kWh in our LiFePO4 battery, we need to buy one with a nominal value of:

100/85 X 31.4 kWh = 36.9 kWh

The results

We found a 42.5 kWh (nominal) battery bank for 16000 Euros, including transport within Europe. It still is about 15% too large, but that is what we found on the market. This extra is no wasted money. Check the ‘durability’ graph and it means the batteries will last an extra year before they reach the minimum of 22.5 kWh.

So, this battery bank will last an estimated 13 years.

We could get the batteries a lot cheaper in China, but our hard condition is an A-brand, with an effective warranty and a tailor-made service. We found that at EV Europe, www.eveurope.eu (generally working business to business).

There were many extra costs (see next paragraph: Starting from scratch….), but now we deal with just the comparison of the renewal of an LFP versus lead acid battery bank.

On maintenance, there is nothing really on costs. You just plug in the charger to the shore power every three months and the battery management system will do the so called ‘balancing’.

It is possible that you have a bad battery. Then, just like with A brand lead acid batteries, you can exchange it for a new one for free (pro rato per year).

Exchanging the lead acid batteries for new lead acid batteries would have cost 9500 Euro, including the transport. The carrying of the batteries is so heavy, that I presume you need to hire a lorry, a strong man, et cetera. This costs money. On the other hand, we could get 500 Euros for the old batteries. In our case this money evens out the carrying/handling costs.

There are some maintenance costs. In every harbor, we plugged in to shore power, because it was best for the batteries. We did a three months acid (density) check of al 24 2-volt batteries and added the demineralized water. This is just a dirty job, costs you a T-shirt sometimes due to the acid, and you need an annual 25 Euro for the demineralized water to top up. So, the maintenance costs are peanuts.

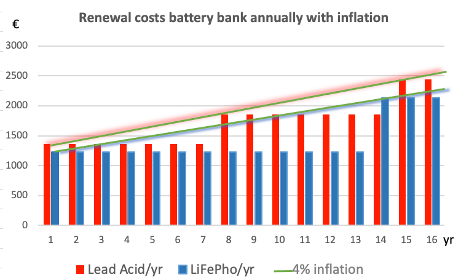

Costs per year to renew the batteries are then:

- Lead acid batteries. 9500 Euro for 7 years, make 1357 Euros per year.

- Lithium Ferro Phosphate. 16000 Euros for 13 years, is 1230 Euros per year.

So LFP costs 127 Euros less per year, so they are even a little bit cheaper than lead acid.

The extra advantages are: near zero maintenance, best safety (fire; toxics). And last but not least: a potential smaller environmental impact, which is good for the life of your children and grandchildren.

Leave your money on the bank, or put it in your bilge?

After so many years of low inflation, we have forgotten this economical phenomenon. But right now, as we speak, in 2021, the inflation has passed 4%. This means that people buying the lead acid batteries for 9500, will pay 9880 Euro a year later, and the year after again 4% extra on that, each year on. And you don’t get 4% interest from your bank. Given the growing demand on batteries, it is most probable that the battery prices will grow with an annual 4%.

So, you’d better buy your durable goods now, as much as you can and as durable as you can. This means, with LFP in your bilge you are better off.

Even if the LFP batteries would cost the same, or a little bit more, they are worth investing in it. Because the investment in a durable good, saves more and more money in the following years.

So, if you have a bit of money, ask yourself: shall I leave it on the bank devaluating, or put it in the form of batteries in my bilge, working for me?

Starting from scratch means: investing in LFP is safer

Up to this point, we discussed the costs of the renewal of a battery bank. But if you think of a complete, new installation and think that lead acid is ‘cheaper’, then check the difference between ‘cheap’ and ‘low initial costs’ first, and don’t cheat yourself. Here is our experience.

We had 5000 extra costs to change the bank from lead acid to LFP. These costs were:

- Initial costs. A battery management system (BMS) for Lithium batteries, plus a lot of cables, connectors, et cetera. All together 3000 Euros. For lead acid this has cost us 1000 Euros. So, the initial extra costs for LFP are 2000 Euro.

- Replacement costs. 1000 Euro on costs for assistance, to get the lead acid out, and the necessary engineering assistance you need to integrate it in the existing electricity system. These costs are a pity, because it was also spent to the engineering necessary when we installed the lead acid…

- Replacement costs for Ya. 1000 kg of lead, to be replaced for the lead acid batteries as internal ballast for the ship’s stability. This costs 2000 Euros. But this is only in the case of Ya, with its center board (no keel).

So, the initial costs for LFP will be 2000 Euro more. Over the 13 years this is

2000 Euro : 13 yr = 153 Euros per year. Add this to the 1230 Euro for the renewal, makes:

1230 + 153 = 1373 Euros for a total replacement of LFP batteries and cables and BMS.

Also, for the lead acid batteries there is some money needed for assistance to get these heavy lead acid batteries in? Think of a lorry, and handling costs of the (in our case) 1.4 ton. Let us say this is 500 Euros, which is initially, and let us spread this over many decades, to be on the safe side. Let us only count 10-15 Euros per year for that, so that makes 1357 +16 Euros = 1373 Euros, just as much as the annual costs for the LFP.

Here under the total picture with the inflation incorporated.

Conclusion

LiFePO4 and lead acid batteries will cost annually the same. If we have inflation, the durable LFP will gain advantage.

Till so far the short term costs. On long term, for our children and grandchildren, we have to take into account all cleanup costs of environmentally dangerous goods we leave behind. Lead and sulfuric acid then, has no future at all, we even don’t have to count that out.

So even if you do prefer the more expensive lead acid batteries, then please take the sustainable development into account. Do you like children? Then, give them a better future and don’t produce more toxic waste than strictly necessary for your life.

Businesswise or sustainable, for both the recommendation is:

- Rethink or refuse: do you need the batteries at all? If yes, then:

- Reduce:

- use only what you need and buy the smallest amount.

- take LFP because it leaves the smallest environmental impact